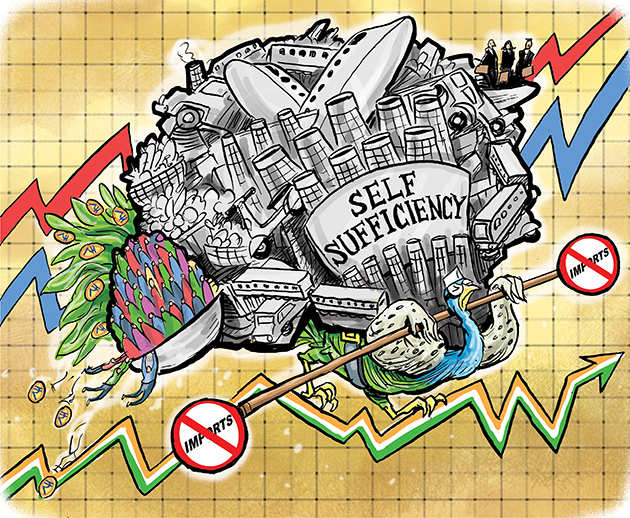

Building Financial Self-Sufficiency: A Practical Guide

Introduction

In today’s fast-paced world, financial independence and self-sufficiency are more than just buzzwords; they are vital cornerstones of a secure and stress-free life. The landscape of personal finance is increasingly complex, yet the fundamental principles of financial management remain surprisingly simple. Achieving financial self-sufficiency means being in control of your finances, not just reacting to them. It means having the freedom to make choices without the constraints of financial stress or uncertainty.

This article aims to guide you through the principles and practices necessary to attain and maintain financial stability. We will explore actionable strategies for managing your finances, highlight common pitfalls to avoid, and provide practical advice for fostering long-term financial health. Whether you are just starting on your financial journey or looking to refine your existing strategies, this guide will offer insights and tools to help you build a more secure and prosperous future.

Financial self-sufficiency is not merely a lofty goal but a crucial component of long-term security and peace of mind. It is about more than just having enough money; it’s about adopting mindful spending and saving practices that enable you to navigate life’s uncertainties with confidence. By understanding and implementing these practices, you can work towards a future where financial concerns do not dictate your choices or diminish your quality of life. This article will provide a comprehensive roadmap to achieving and maintaining financial independence, empowering you to take control of your financial destiny.

1. Your Children Are Not Your Retirement Fund

Relying on your children as your primary source of retirement funding is both unfair and impractical. This approach places an undue burden on them and jeopardizes their financial well-being, potentially leading to strained familial relationships and financial instability. Instead, it is crucial to take proactive steps to plan and save for your own retirement, ensuring that you can enjoy your later years without depending on your children.

Children are not financial safety nets. They have their own lives, careers, and financial obligations, and expecting them to support you in retirement can create significant stress and strain. This reliance can foster feelings of resentment and create tensions within the family, as your children may feel pressured to divert their own financial resources towards your support. Additionally, they might face difficulties in managing their own finances if they are unexpectedly tasked with supporting aging parents.

Financial dependence on your children can also undermine their ability to save for their own future. Young adults often face their own financial challenges, such as student loans, mortgages, and starting families. By asking them to shoulder the responsibility of your retirement, you inadvertently compromise their financial stability and long-term goals.

To secure your financial future and maintain healthy family relationships, it is essential to plan and save for retirement independently. Here’s how you can achieve this:

- Start Early: Begin saving for retirement as early as possible. The earlier you start, the more time your money has to grow through compound interest. Even small, consistent contributions can accumulate significantly over time.

- Establish a Retirement Fund: Open a dedicated retirement account, such as a PF, Insurance or post office savings or similar retirement savings plan, depending on your location and financial situation. Take advantage of employer contributions and tax benefits associated with these accounts.

- Invest Wisely: Diversify your investments to balance risk and return. Consider a mix of stocks, bonds, and other assets to build a robust portfolio that aligns with your risk tolerance and retirement goals.

- Create a Budget: Develop a budget that includes contributions to your retirement savings. Prioritize your retirement fund alongside other essential expenses and financial goals.

- Regularly Review and Adjust: Periodically review your retirement plan and adjust your contributions and investments as needed. Monitor your progress and make changes based on market conditions and life changes.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized retirement plan. They can provide guidance on investment strategies, tax implications, and other aspects of retirement planning.

By taking these steps, you will not only ensure your financial independence in retirement but also preserve the harmony and financial health of your family. Embracing personal responsibility for your retirement allows you to enjoy your later years with dignity and peace of mind, free from the financial pressures that could otherwise burden your loved ones.

2. Your Parents Are Not Your Emergency Fund

Relying on your parents as a financial safety net during emergencies is not only unfair but can also compromise both their financial security and your own. It is crucial to establish and maintain your own emergency fund to manage unforeseen expenses independently. This practice ensures that you are prepared for financial challenges without burdening your parents or disrupting family dynamics.

Depending on your parents for financial emergencies can have several negative impacts:

- Financial Strain on Parents: Your parents may already have their own financial commitments, such as retirement savings, healthcare costs, or other personal expenses. Asking them to provide financial support during emergencies can strain their resources and potentially affect their long-term financial stability.

- Personal Financial Instability: Relying on others for emergency funds can delay the development of your own financial stability. Without a personal safety net, you may find yourself frequently scrambling for funds, which can lead to stress and poor financial decision-making.

- Family Relationships: Financial dependence can create tension and strain within family relationships. Parents may feel obligated to help, which can lead to feelings of resentment or frustration if they are unable to meet your needs or if the assistance disrupts their own financial plans.

- Lack of Financial Preparedness: Failing to build an emergency fund means you are unprepared for unexpected expenses, such as medical emergencies, car repairs, or job loss. This lack of preparation can force you into debt or result in financial decisions that negatively impact your long-term goals.

To ensure financial stability and preserve familial relationships, it is essential to build and maintain your own emergency fund. Here’s how to create a robust financial safety net:

- Set a Savings Goal: Aim to save at least six months’ worth of living expenses. This amount provides a buffer to cover essential costs during periods of financial disruption, such as job loss or unexpected expenses.

- Open a Separate Account: Create a dedicated savings account for your emergency fund. This account should be easily accessible but separate from your regular checking and savings accounts to avoid the temptation of using the funds for non-emergency purposes.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund. This ensures consistent contributions without the need for manual intervention and helps in gradually building your savings over time.

- Monitor and Adjust: Regularly review your emergency fund balance and adjust your savings goals as needed. If your expenses increase or you experience significant life changes, update your emergency fund target to maintain adequate coverage.

- Prioritize and Save: Incorporate emergency fund contributions into your budget. Treat these contributions as a non-negotiable expense, similar to rent or utilities, to ensure that you consistently add to your fund.

- Avoid Unnecessary Withdrawals: Use your emergency fund only for genuine emergencies. Avoid withdrawing from it for non-essential purchases or planned expenses, as this can deplete your safety net and reduce your preparedness for real emergencies.

By taking these steps, you will establish a solid foundation for managing unexpected financial challenges independently. This proactive approach not only strengthens your financial security but also respects and preserves the financial health and relationships within your family.

3. Plan Your Finances

A well-structured financial plan is fundamental for achieving long-term financial goals and ensuring sustained financial health. Without a comprehensive plan, managing finances can become reactive rather than proactive, leading to missed opportunities and potential financial instability. A strategic financial plan provides clarity and direction, enabling you to make informed decisions that foster financial growth and security.

Effective financial planning is crucial for several reasons:

- Budgeting: A financial plan helps you create and maintain a budget, which is essential for managing daily expenses and avoiding overspending. A well-crafted budget ensures that you allocate funds appropriately to cover necessities while setting aside money for savings and investments.

- Saving: Planning allows you to set and achieve savings goals. Whether it’s for an emergency fund, a vacation, or a large purchase, having a clear plan helps you prioritize savings and monitor progress towards these goals.

- Investing Wisely: With a financial plan, you can make informed investment decisions that align with your risk tolerance and long-term objectives. A structured approach to investing maximizes returns and helps in building wealth over time.

- Debt Management: A financial plan assists in managing and reducing debt. By allocating resources towards paying off high-interest debt and avoiding new debt, you can improve your financial health and reduce financial stress.

- Financial Growth and Security: Regularly reviewing and adjusting your financial plan helps you stay on track with your goals, adapt to life changes, and capitalize on new opportunities. This ongoing management is key to achieving financial stability and growth.

To create and maintain a robust financial plan, follow these steps:

- Assess Your Financial Situation: Start by evaluating your current financial status. Gather information on your income, expenses, debts, and assets. Understanding where you stand is the first step in developing a comprehensive plan.

- Set Financial Goals: Define short-term, medium-term, and long-term financial goals. These might include saving for a down payment on a house, planning for retirement, or funding a child’s education. Be specific about your goals and set realistic timelines for achieving them.

- Create a Detailed Budget: Develop a budget that tracks your income and expenses. Categorize your spending to identify areas where you can cut costs and allocate more towards savings and investments. Ensure that your budget is balanced, with a clear distinction between essential and discretionary expenses.

- Develop a Savings Strategy: Allocate a portion of your income to savings. This includes building an emergency fund, saving for specific goals, and contributing to retirement accounts. Automate your savings to ensure consistent contributions.

- Invest Strategically: Based on your financial goals and risk tolerance, create an investment strategy. Diversify your investments across different asset classes (stocks, bonds, real estate) to mitigate risk and enhance potential returns. Consider consulting with a financial advisor for personalized investment advice.

- Monitor and Review Regularly: Regularly review your financial plan to track progress and make necessary adjustments. Life changes such as a new job, marriage, or the birth of a child may require updates to your plan. Schedule periodic reviews to stay on top of your financial situation and ensure alignment with your goals.

- Adjust as Needed: Be prepared to adapt your plan in response to changes in your financial circumstances or market conditions. Flexibility is key to maintaining financial stability and achieving long-term objectives.

- Seek Professional Advice: Consult with financial professionals, such as financial planners or advisors, to gain insights and expertise tailored to your specific needs. They can provide valuable guidance on complex financial matters and help optimize your plan.

By implementing these steps, you can create a comprehensive financial plan that serves as a roadmap to achieving your financial aspirations. A well-structured plan not only provides direction but also empowers you to make informed decisions, build wealth, and secure your financial future.

4. Maintain a Cash Reserve

Maintaining a cash reserve is essential for managing unexpected expenses and ensuring financial stability. A well-funded cash reserve acts as a financial safety net, allowing you to handle emergencies without resorting to credit or loans. This practice is a cornerstone of sound financial management, providing peace of mind and protecting you from the stress of unforeseen financial challenges.

- Emergency Preparedness: Cash reserves serve as a buffer against sudden financial shocks, such as medical emergencies, car repairs, or job loss. Without a cash reserve, you may have to rely on high-interest credit cards or loans, which can exacerbate financial stress and lead to long-term debt.

- Avoiding Debt: Having a cash reserve prevents the need to incur debt for emergencies. Relying on credit or loans for unforeseen expenses can result in additional interest costs and financial strain. A well-funded reserve allows you to cover unexpected costs without compromising your financial health.

- Financial Stability: A cash reserve contributes to overall financial stability by providing a cushion against fluctuations in income or unexpected expenses. This stability allows you to make thoughtful financial decisions rather than reacting impulsively to immediate pressures.

- Peace of Mind: Knowing that you have a cash reserve provides peace of mind and reduces financial anxiety. It allows you to face emergencies with confidence, knowing you have the resources to manage the situation without disrupting your long-term financial goals.

To effectively establish and maintain a cash reserve, follow these steps:

- Determine the Reserve Amount: Aim to set aside at least six months’ worth of living expenses. This amount provides a sufficient buffer to cover essential costs during periods of financial disruption. Calculate your monthly expenses, including housing, utilities, groceries, and other necessities, to determine the appropriate reserve size.

- Open a Separate Account: Create a dedicated savings account for your cash reserve. This account should be easily accessible but separate from your regular checking and savings accounts. Keeping your cash reserve in a separate account helps prevent the temptation to use the funds for non-essential purchases.

- Automate Contributions: Set up automatic transfers from your primary account to your cash reserve account. Automating contributions ensures consistent savings and helps you build your reserve steadily over time without needing to manually deposit funds.

- Regularly Contribute and Replenish: Treat contributions to your cash reserve as a priority. Regularly review and adjust your contributions based on changes in your financial situation or expenses. If you use any of the funds in your reserve, make it a priority to replenish the account as soon as possible.

- Avoid Non-Essential Withdrawals: Use your cash reserve exclusively for genuine emergencies. Avoid withdrawing from this fund for planned expenses or discretionary purchases, as this can deplete your safety net and leave you unprepared for real emergencies.

- Review and Adjust: Periodically review your cash reserve to ensure it meets your current needs. Adjust the reserve amount if your living expenses increase or if you experience significant life changes. Keeping your reserve aligned with your financial situation is key to maintaining its effectiveness.

- Consider Inflation and Interest Rates: Be mindful of inflation and interest rates when managing your cash reserve. While it’s important to keep your reserve easily accessible, consider options that offer modest interest to help your reserve grow over time.

By following these steps, you will establish a robust cash reserve that supports your financial stability and provides a cushion against unexpected expenses. A well-maintained cash reserve not only safeguards you from financial emergencies but also contributes to overall peace of mind and financial resilience.

5. Avoiding Debt: Live Within Your Means

Avoiding debt and living within your means is fundamental to maintaining financial health and stability. By managing your spending and focusing on what you can afford, you build a solid foundation for savings and financial security. Embracing a debt-free lifestyle helps prevent financial stress and sets you on a path to long-term economic well-being.

- Financial Stress: Debt can cause significant stress and anxiety, impacting your overall well-being. The burden of repaying loans and managing interest payments can lead to sleepless nights and constant worry, affecting both your mental and physical health.

- Long-Term Financial Issues: Accumulating debt, especially high-interest debt, can have long-term consequences. It may hinder your ability to save for future goals, such as retirement or a home purchase, and can lead to a cycle of borrowing that is difficult to escape.

- Impact on Savings: Debt repayments can consume a significant portion of your income, leaving less money available for savings and investments. By avoiding debt, you can allocate more funds towards building an emergency fund, investing, and achieving your financial goals.

- Financial Stability: Living within your means helps ensure consistent financial stability. It allows you to manage your resources effectively, avoid financial pitfalls, and make sound financial decisions that contribute to long-term security.

To avoid debt and live within your means, implement the following strategies:

- Use Cash or Debit Cards: Opt for cash or debit cards for everyday purchases. These payment methods help you stay within your budget and avoid the temptation to overspend. Unlike credit cards, which can lead to accumulating debt, cash and debit card transactions are limited to the funds available in your account.

- Avoid Credit Cards and Loans for Non-Essential Items: Refrain from using credit cards or taking out loans for non-essential purchases. Reserve credit cards for emergencies or planned expenses that you can pay off in full each month. Avoiding unnecessary debt prevents the accumulation of high-interest balances and promotes financial discipline.

- Create and Stick to a Budget: Develop a detailed budget that outlines your income, expenses, and savings goals. Track your spending to ensure it aligns with your budget and adjust as necessary. A well-planned budget helps you manage your finances and avoid overspending.

- Prioritize Essential Expenses: Focus on spending only what you have and prioritize essential expenses such as housing, utilities, and groceries. By managing your spending on necessities, you ensure that your basic needs are met while avoiding debt.

- Build a Savings Cushion: Establish a savings fund to cover planned expenses and emergencies. Having a savings cushion reduces the need to rely on credit cards or loans when unexpected costs arise. Aim to save a portion of your income regularly to build and maintain this fund.

- Track and Analyze Spending: Regularly review your spending habits to identify areas where you can cut costs and improve financial management. Use financial tracking tools or apps to gain insights into your spending patterns and make informed adjustments to your budget.

- Set Realistic Financial Goals: Establish achievable financial goals that align with your income and budget. Set short-term and long-term objectives, such as paying off debt, saving for a vacation, or investing in your future. Working towards these goals helps you stay motivated and disciplined in managing your finances.

- Seek Professional Advice: If you’re struggling with debt or financial management, consider consulting a financial advisor. They can provide personalized guidance on budgeting, debt management, and financial planning to help you achieve a debt-free lifestyle.

By adopting these practices, you can avoid debt, live within your means, and build a secure financial future. Managing your finances responsibly not only enhances your financial health but also fosters a sense of control and confidence in your economic well-being.

6. Distinguish Needs from Wants

Spending wisely hinges on the ability to distinguish between needs and wants. By focusing on fulfilling essential needs before allocating funds to discretionary wants, you can manage your finances more effectively and avoid depleting resources that are crucial for your financial stability. Prioritizing needs helps ensure that your essential expenses are covered and supports your long-term savings and financial goals.

- Resource Allocation: Spending on non-essential items, or wants, can divert funds away from essential needs and savings. When resources are allocated to discretionary spending, you may find yourself short of funds for critical expenses such as housing, utilities, healthcare, and debt repayments.

- Financial Strain: Excessive spending on wants can lead to financial strain, especially if it results in insufficient savings or debt accumulation. By focusing on needs, you avoid financial stress and ensure that your budget remains balanced and sustainable.

- Long-Term Goals: Prioritizing needs over wants helps you allocate resources towards achieving long-term financial goals, such as building an emergency fund, saving for retirement, or paying off debt. Proper resource allocation supports financial growth and stability.

- Financial Discipline: Differentiating between needs and wants fosters financial discipline and helps you make more informed spending decisions. It encourages mindfulness in your financial habits and prevents impulsive purchases that can disrupt your budget.

To effectively distinguish between needs and wants and manage your spending, follow these steps:

- Create a Detailed Budget: Develop a budget that categorizes your expenses into needs and wants. Needs are essential items necessary for daily living, such as rent, groceries, utilities, and healthcare. Wants are non-essential items or services, such as dining out, entertainment, and luxury goods.

- Identify and Prioritize Needs: List and prioritize your needs, ensuring that you allocate sufficient funds to cover these essential expenses. Needs should be addressed first in your budget to ensure that your basic requirements are met.

- Evaluate Discretionary Spending: Assess your spending on wants and determine if these expenses are necessary or if they can be reduced or eliminated. Consider whether these purchases align with your long-term financial goals and overall budget.

- Implement a Spending Plan: Set limits on discretionary spending to avoid overspending on wants. Allocate a specific portion of your budget to non-essential items while ensuring that essential expenses and savings goals are met.

- Practice Mindful Spending: Before making a purchase, evaluate whether it is a need or a want. Ask yourself if the purchase will impact your financial goals or if it can be deferred or avoided. Mindful spending helps you stay within your budget and maintain financial discipline.

- Regularly Review Your Budget: Periodically review your budget and spending habits to ensure that you are effectively distinguishing between needs and wants. Adjust your budget as needed to reflect changes in your financial situation or goals.

- Set Financial Goals: Establish clear financial goals that align with your needs and long-term objectives. By focusing on these goals, you can make more informed decisions about discretionary spending and prioritize activities that support your financial aspirations.

- Seek Alternative Solutions: For some wants, consider finding more cost-effective alternatives. For example, instead of dining out frequently, explore cooking at home or trying budget-friendly recipes. Small adjustments can make a significant impact on your overall spending.

By distinguishing between needs and wants, you can create a balanced budget that supports both your essential expenses and financial goals. This approach promotes effective financial management, reduces unnecessary strain, and helps you build a more secure and stable financial future.

7. Beware of “Get Rich Overnight” Schemes

Schemes that promise rapid wealth accumulation are often fraught with risk and unreliability. These schemes may lead to significant financial losses and can sometimes be outright scams. True wealth is typically the result of consistent effort, prudent financial management, and strategic long-term planning. It is crucial to approach such schemes with skepticism and focus on proven, legitimate financial strategies for sustainable financial growth.

- High Risk of Loss: “Get rich overnight” schemes often involve high-risk investments or speculative ventures that can result in substantial financial losses. Many of these schemes are designed to exploit hopeful investors rather than provide genuine opportunities for wealth creation.

- Scams and Fraud: Some schemes promising quick wealth are actually fraudulent operations aimed at deceiving individuals out of their money. These scams may offer unrealistic returns or pressure you to invest quickly without adequate information or due diligence.

- Unstable Returns: Quick wealth schemes usually lack stability and reliability. The promises of high returns in a short period are often unsustainable and can lead to financial instability when the scheme fails or collapses.

- Long-Term Financial Health: Sustainable wealth building is typically a result of consistent effort, smart financial planning, and disciplined saving and investing. Quick-fix schemes can undermine long-term financial health by diverting attention from proven strategies and creating financial volatility.

To build wealth responsibly and avoid the pitfalls of “get rich overnight” schemes, follow these strategies:

- Invest in Proven Financial Strategies: Focus on investments with a track record of reliability and performance. Consider established options such as diversified stock portfolios, mutual funds, index funds, and bonds. These investments offer steady growth potential and are supported by historical performance.

- Adopt a Long-Term Perspective: Wealth building is a gradual process. Prioritize long-term investment strategies that emphasize steady growth and compound returns. This approach involves patience and discipline but is more likely to yield sustainable results.

- Educate Yourself: Gain knowledge about financial markets, investment principles, and personal finance. Understanding the fundamentals helps you make informed decisions and avoid falling for misleading schemes. Resources include financial education books, reputable websites, and courses offered by financial institutions.

- Seek Professional Advice: Consult with a financial advisor or planner to develop a personalized investment strategy. Professional advisors can provide valuable insights, help you navigate investment options, and avoid high-risk schemes.

- Evaluate Risk and Return: Carefully assess the risk and return associated with any investment opportunity. High returns often come with high risk. Ensure that any investment aligns with your risk tolerance and financial goals.

- Avoid High-Pressure Sales Tactics: Be cautious of investment opportunities that involve high-pressure sales tactics or demand immediate action. Legitimate investments will provide ample time for research and consideration, without pressuring you to make quick decisions.

- Verify Credibility: Research the credibility and track record of any investment opportunity or financial scheme. Check for reviews, regulatory compliance, and transparency. Verify the legitimacy of the company or individual offering the investment.

- Diversify Your Investments: Avoid putting all your money into a single investment or scheme. Diversify your investments across various asset classes to spread risk and enhance the stability of your financial portfolio.

By steering clear of schemes that promise quick wealth and focusing on proven, legitimate financial strategies, you can build wealth in a reliable and sustainable manner. Responsible financial management, education, and long-term planning are key to achieving financial success and avoiding the pitfalls of risky ventures.

8. Effort as a Path to Wealth

Building wealth is not an overnight phenomenon but a process that requires sustained effort, patience, and intelligent financial decision-making. Sustainable wealth accumulation stems from consistent hard work, prudent financial management, and informed investing. Committing to these principles will help you build and preserve wealth over time, ensuring long-term financial stability and success.

- Consistency and Patience: Accumulating wealth is a gradual process that demands consistency and patience. Unlike “get rich overnight” schemes, real wealth is built through steady, disciplined actions over time. This approach allows you to benefit from compound growth and mitigate the risks associated with high-stakes, short-term investments.

- Prudent Financial Management: Effective financial management involves making informed decisions about budgeting, saving, and investing. By managing your finances prudently, you create a strong foundation for wealth accumulation and avoid pitfalls that can derail your financial goals.

- Informed Investing: Sustainable wealth is often the result of strategic investing in assets that offer long-term growth potential. Informed investing involves understanding market trends, evaluating investment opportunities, and aligning your investments with your financial goals and risk tolerance.

- Avoiding Shortcuts: Relying on shortcuts or high-risk schemes can undermine your financial stability and lead to losses. Building wealth through effort and diligence is a more reliable approach, fostering a solid financial base and minimizing the risks of significant financial setbacks.

To build and preserve wealth through effort and smart financial decisions, consider the following strategies:

- Commit to Financial Education: Continuously educate yourself about personal finance, investing, and market trends. Stay informed about economic developments and investment strategies through books, articles, online courses, and financial news. This knowledge will help you make better financial decisions and adapt to changing market conditions.

- Practice Disciplined Saving: Establish and adhere to a savings plan that prioritizes regular contributions to savings and investment accounts. Automate your savings to ensure consistency and avoid the temptation to spend the money elsewhere. Discipline in saving is key to building a substantial financial cushion.

- Develop a Strategic Investment Plan: Create an investment strategy that aligns with your financial goals, risk tolerance, and time horizon. Diversify your investments across various asset classes, such as stocks, bonds, and real estate, to manage risk and enhance potential returns. Regularly review and adjust your investment portfolio to stay on track with your objectives.

- Set and Monitor Financial Goals: Define clear financial goals, both short-term and long-term. These might include building an emergency fund, saving for retirement, or funding a major purchase. Regularly monitor your progress towards these goals and make adjustments to your strategy as needed.

- Embrace Long-Term Planning: Focus on long-term financial planning rather than seeking immediate gains. Long-term planning allows you to benefit from compound interest, manage risks, and achieve sustainable growth. Avoid making impulsive financial decisions based on short-term market fluctuations.

- Seek Professional Guidance: Consider consulting with a financial advisor to develop a comprehensive wealth-building strategy. An advisor can provide personalized recommendations, help you navigate complex financial decisions, and offer insights into optimizing your investment approach.

- Build Multiple Income Streams: Explore opportunities to diversify your income sources. This might include side businesses, passive income investments, or additional skills and education that enhance your earning potential. Multiple income streams provide financial stability and contribute to wealth accumulation.

- Maintain Financial Discipline: Exercise discipline in your financial habits, such as budgeting, spending, and investing. Avoid lifestyle inflation and make thoughtful decisions about large purchases and investments. Financial discipline ensures that your wealth-building efforts are effective and sustainable.

By embracing effort, patience, and informed decision-making, you can build and preserve wealth over time. Committing to ongoing financial education, disciplined saving, and strategic investing will set you on the path to long-term financial success and stability.

Conclusion

Achieving financial self-sufficiency is a multifaceted journey that involves careful planning, disciplined saving, and informed investing. Key strategies for reaching financial stability include:

- Independent Retirement Planning: Ensure you are not relying on your children for retirement funds. Begin saving and investing early to build a secure retirement.

- Building an Emergency Fund: Create and maintain a cash reserve that covers at least six months of living expenses to manage unforeseen situations without falling into debt.

- Effective Financial Planning: Develop a comprehensive budget that includes all income, expenses, savings, and investments. Regularly review and adjust this plan to stay aligned with your financial goals.

- Living Within Your Means: Avoid debt by using cash or debit cards for purchases and focusing on spending only what you have. Prioritize essential expenses and avoid non-essential debt.

- Distinguishing Needs from Wants: Differentiate between essential needs and discretionary wants. Allocate funds to cover needs first and manage discretionary spending carefully.

- Avoiding Risky Schemes: Be wary of schemes promising quick wealth. Invest in proven, legitimate financial strategies and focus on long-term growth.

- Commitment to Effort: Recognize that building wealth requires consistent effort, patience, and smart financial decisions. Commit to ongoing education, disciplined saving, and strategic investing.

Call to Action:

Empower yourself to take control of your financial future by implementing these strategies. Start by creating a budget, setting financial goals, and building an emergency fund. Educate yourself about personal finance and make informed decisions to build and preserve your wealth. Consider participating in financial literacy workshops to enhance your understanding and skills. Your proactive steps today will contribute to a secure and stable financial future.

Support financial education initiatives by considering donations to organizations that promote financial literacy and stability. Your contribution can help others gain the knowledge and tools needed to achieve financial self-sufficiency.

Book Reading References:

- “The Total Money Makeover” by Dave Ramsey – Offers practical advice on budgeting, saving, and eliminating debt.

- “Rich Dad Poor Dad” by Robert T. Kiyosaki – Provides insights on building wealth through investing and financial education.

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez – Focuses on transforming your relationship with money and achieving financial independence.

- “The Intelligent Investor” by Benjamin Graham – A classic guide to value investing and financial strategy.

- “Financial Freedom” by Grant Sabatier – Offers strategies for achieving financial independence and building wealth.

- “The Barefoot Investor” by Scott Pape – Provides practical advice on managing money, investing, and achieving financial security.